Surprise balance bills occur when patients receive unanticipated charges for health care services because they were unaware that care was delivered by an out-of-network provider or facility. In some cases, surprise balance bills can amount to hundreds if not thousands of dollars in medical expenses.

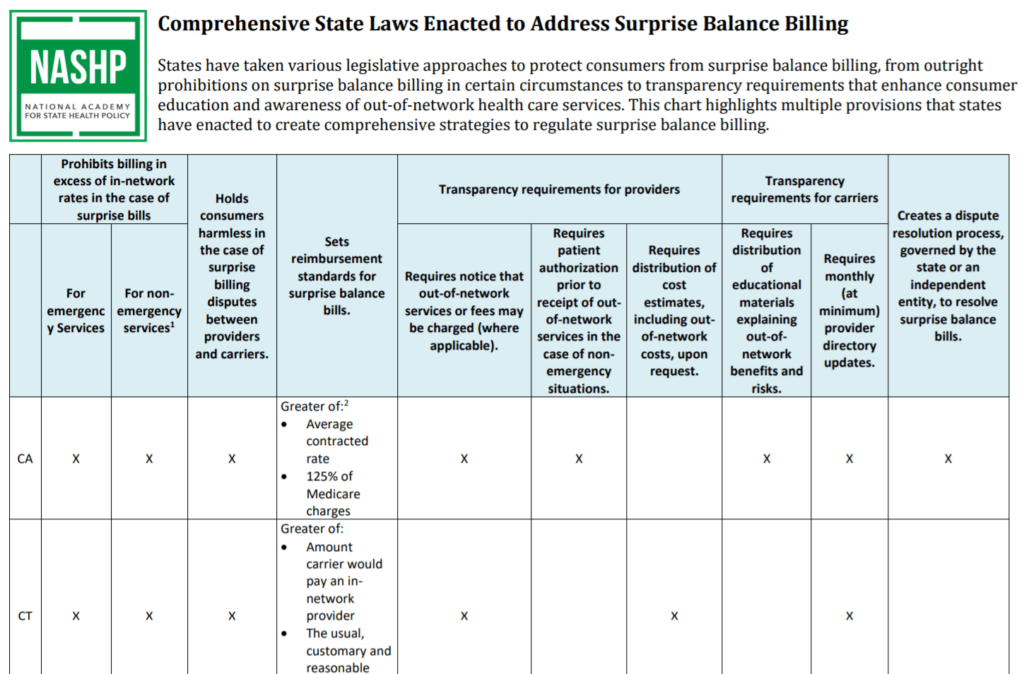

A growing number of states have passed or are proposing laws to protect consumers with one or more of these safeguards:

- They prohibit balance billing in certain circumstances — usually when a consumer had no other provider choice;

- They hold consumers harmless when insurance carriers and providers dispute a balance bill;

- They set reimbursement standards for providers in the case of balance bills;

- They require providers and carriers to provide accurate and updated information about the provision of in- and out-of-network services; and

- They establish a balance billing dispute resolution process, facilitated by the state or an independent entity.

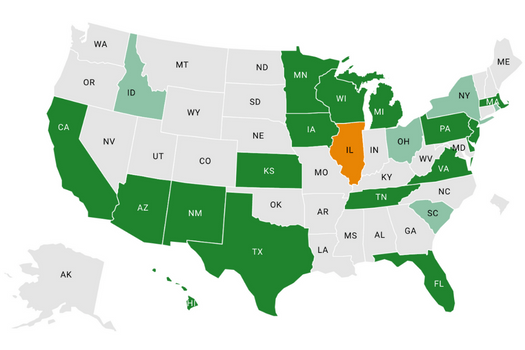

This chart highlights multiple safeguards that seven states have enacted to create a comprehensive strategy to regulate surprise balance billing. To date, at least 22 states have introduced legislation during this session to establish or strengthen surprise balance billing protections. NASHP will continue to monitor and report on new legislative developments.