States that control their own insurance marketplaces – called state-based marketplaces (SBMs) – are leaders in providing affordability and choice, outperforming the federal marketplace on notable markers including higher enrollment, lower premium rate hikes, more participating issuers, and successfully attracting a young consumer base. These accomplishments are especially notable given recent federal policy actions that have unsettled insurance markets and a national rise in uninsured rates.

The success of SBMs results from years of hard work spent cultivating their markets while building operational and technical systems tailored to serve their states’ consumers. Thanks to the work of these SBMs and the evolution of new technology, it is now easier (and cheaper) for states currently using the federal platform to switch and adopt the SBM model.

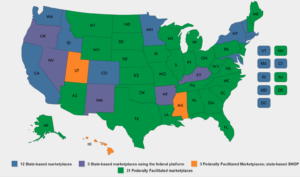

Ten states and Washington, DC (representing nearly 25 percent of the US population) operate SBMs, meaning the state has taken full authority to build and maintain its health insurance marketplace.

SBMs consistently outperform states that use the federal marketplace in areas of enrollment, affordability, and increased plan offerings and competition.

Their flexible structure allows SBMs to focus marketing and outreach efforts to state-specific needs and promote policies that generate more health coverage choices at lower costs.

Click here for more information about SBMs.

As new states express interest in the SBM model, they can learn much from the leaders who have pioneered implementation of this model.

Earlier this month, the National Academy for State Health Policy (NASHP) hosted a webinar with SBM leaders from Idaho, Nevada, Massachusetts, and Washington, DC to showcase some of their lessons. Highlights are featured below, and a recording and slides from the webinar are available here.

Focus on the Basics (and Avoid Scope Creep)

SBMs provide more than shop-and-compare websites for consumers shopping for health insurance — SBMs are dynamic business enterprises. While their main objective is to make sure that individuals have “easy access to health coverage,” SBMs must also:

- Perform a series of complicated eligibility and enrollment functions easily;

- Work with the systems of partner organizations, including carriers, Medicaid, and outreach partners; and

- Be financially sustainable.

Rather than get carried away by bells, whistles, and complex policy aspirations, SBM leaders advise that future SBMs must first focus on building a functional, sustainable system. Once a working SBM is established with a long-term financing strategy, it can always grow and evolve to perform new functions.

Prioritize the Consumer Experience

Much of an SBM’s success depends on its ability to attract and retain consumers. Over the years, SBMs have worked diligently to improve the experience of its consumers. As Massachusetts Health Connector Chief of Policy and Strategy Audrey Gasteier explained, “Marketplaces require a lot of activity on the part of a consumer,” and it is important that consumers feel empowered. Outreach is a major component of this work – from providing educational materials to in-person assistance provided by brokers, Navigators, and certified application counselors. Earned press coverage and social media are also effective tools for SBMs to quickly spread the word about their products and policy changes at low cost. Speakers also noted the importance of call centers and recommended that states equip their centers with self-service capabilities so that consumers can easily resolve common issues over the phone.

Set Clear Expectations and Timelines

Heather Korbulic, executive director of Nevada’s SBM, presented an 18-month timeline for implementation of an SBM – from passage of enabling legislation to the marketplace’s first open enrollment period. While “out-of-the box” technology and adaptable systems make it easier than ever to for a state to build an SBM leaders cautioned states not to be too aggressive in their planning and timetables. As with any large-scale project, states should anticipate delays and challenges. For example, from the start states need to work closely with federal officials from the Center Consumer Information and Insurance Oversight (CCIIO) to establish their marketplace “blueprint.” While CCIIO experts serve as an important resource for states – providing years of technical and policy expertise to help guide states – implementation of an SBM requires strict federal oversight and approvals that may cause delays that are outside of the control of a state.

Throughout the SBM implementation process, leaders emphasized the importance of maintaining transparency so that stakeholders are not deterred by unexpected delays or issues. By keeping stakeholders informed of progress and expectations, an SBM will cultivate trust and maintain relationships critical to the marketplace’s long-term success.

Relationships Are the Foundation of an SBM

Any marketplace cannot function without engagement across a mix of stakeholders, which include:

- State policymakers who will establish the marketplace;

- Federal officials who will oversee and approve its implementation;

- Insurance carriers who will sell products through the marketplace; and

- Consumers whom the marketplace will serve.

Stakeholders will have different – and sometimes conflicting – interests and it is the job of the marketplace to balance those interests in pursuit of mutual goals. Leaders underscored the importance of insurer engagement, recognizing the central role of health plans in the success of the marketplace. Establishment of an SBM will require insurers in the state to establish new business practices. A state should not underestimate the uniqueness of how each carrier operates and the time it may take for each to adapt to the new SBM system.

Establish Clear Leadership that Can Take Quick Action

A state has the flexibility to choose how to establish its SBM – either as a state agency, a non-profit, or a quasi-public-private entity. Because an SBM must be responsive to changing consumer and insurer markets and be able to readily contract with vendors to develop needed services, it is best that an SBM assume a governance structure that can enable it to act quickly. Moreover, leaders directors noted the importance of leadership to any marketplace. While operation of an SBM takes a team, it is important to have one person who is clearly designated to establish priorities, take accountability, and make decisions to get the SBM “across the finish line.”

SBMs Serve as a “Hub” for Health Reform across State Agencies.

Regardless of the specific model chosen, SBMs must be able to work across existing state agencies including Medicaid, insurance departments, and other health policy agencies. SBMs are uniquely positioned to serve consumers who range from those on the cusp of Medicaid eligibility to those accustomed to various types of commercial market coverage. To ensure smooth processes for consumers, SBMs must be able to navigate between agencies to ensure that its policies and operations are consistent with what is being promulgated by its sister agencies.

For instance, SBMs are required to generate many different types of notices to consumers, such as information related to a consumer’s eligibility for coverage programs. SBMs coordinate closely with their Medicaid agencies on the language and process for sending these notices to help reduce confusion for consumers who might otherwise receive duplicative or misaligned information from both agencies. Additionally, because SBMs serve consumers who are eligible for federal tax credits, they serve an important role in informing state and federal policymakers about how policy changes may directly impact their consumers. To serve this role, it is important that SBMs have sufficient analytic capacity to process data on their consumers and advise on the implications of changing federal and state policies.

Let SBMs Adapt Over Time

Insurance markets and marketplace consumers are not static, and SBMs must be able to adjust to changing needs and consumers. They must constantly work to engage new consumers who may be coming in and out of other coverage programs (e.g., leaving parental coverage, employer-sponsored insurance, or Medicaid), while also adapting to evolving expectations as consumers interact more and more with e-commerce and advanced technology. Through consumer surveys and testing, SBMs are constantly learning and adapting their services. One benefit of their flexible structure is that SBMs are also becoming more sophisticated and efficient in navigating this process. Some have even been able to cut operational expenses and lower the assessments they charge to carriers who sell on their exchanges, which, in turn, results in lower consumer premiums. For example, Mila Kofman, executive director of DC Health Link, estimates her SBM was able to save approximately $2 million annually by moving its data servers to a cloud-based system in 2016.

Most notably, leaders point out that each SBM has taken a unique approach in how it has operationalized its marketplace. In the process, each has learned lessons from their SBM peers – from simply sharing effective marketing strategies to full partnerships, like Massachusetts’ adoption of Washington, DC’s technology for its small business marketplace. In this spirit, speakers advised states to learn from their peers as they work through their own challenges on the road to implementing SBMs.

NASHP and the SBMs are ready and eager to help support states as they contemplate establishing their own SBMs. For additional resources about SBM models and implementation, explore NASHP’s State Exchange Resource Hub.